About

Established in 2022, Crew Enterprises specializes in multifamily and student housing, managing a diverse $2.0 billion portfolio across the US, focused on strategic growth and sustainable living.

Crew Enterprises

Company Profile

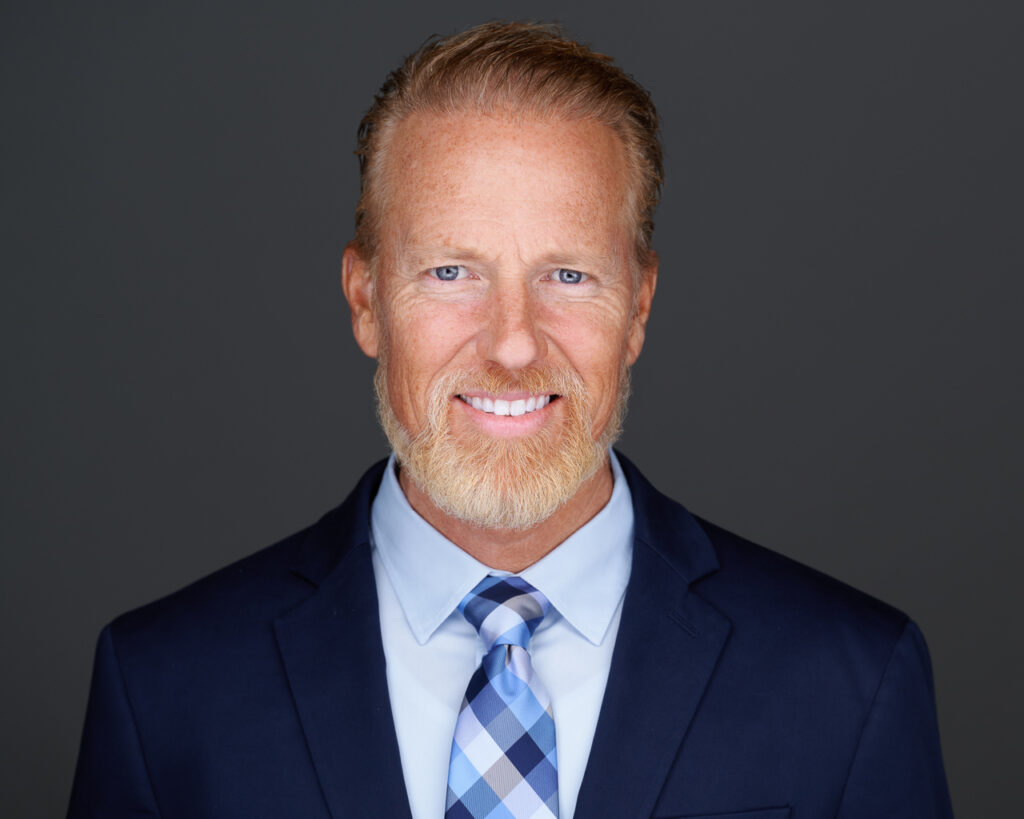

Crew Enterprises, founded in 2022 by Blake Wettengel and Tanya Muro, is a real estate company specializing in acquiring and operating student and multifamily housing properties.

The investment firm and its affiliated companies own or manage 37 student housing and multifamily properties located throughout the United States, totaling approximately 5,000 units and over 11,000 beds.

Located in Orange County, California, Crew Enterprises has a portfolio valued at nearly $2.0 billion across 18 states and is one of the largest syndicators of real estate in the country.

Crew Enterprises has raised several hundred million dollars in equity investments and aims to provide clients with strong, risk-adjusted investment strategies while creating inspiring living experiences for tenants through selective acquisitions and development, focusing on high-enrollment, housing supply-constrained locations, and utilizing enhanced social and environmentally responsible practices.

Executive Experience

Company Size

Investment Focus

Mix Of Student & Multifamily Properties

Crew Enterprises Student Housing investments focus on long-standing institutions with significant market opportunity and campus proximity.

Crew Enterprises Multifamily strategy targets Class A communities in densely populated and rapidly growing real estate markets.

Investment Strategy

Investor-Centric approach to Real Estate Investments

Crew Enterprises takes an investor-centric approach to real estate investment, identifying investor goals and objectives, and then creating strategies that align with those goals.